News:

The Ugly Battle Over the Wildenstein Art Empire

By James Tarmy and Vernon Silver

Once the world’s richest and most influential dealers, the family is trying to fight off a half-billion dollar tax bill.

(Clockwise, from top left) Vincent Van Gogh’s Roses, 1890, donated by the Annenberg family to the Met in 1993. In 1951 the Wildensteins bought it for $100,000 and sold in 10 days later for $135,000; Michelangelo da Caravaggio’s The Lute Player, circa 1597, long thought to be a second-rate copy. The Wildensteins “discovered” it in their New York vault; Jean-Baptiste Carpeaux’s Ugolino and His Sons, 1867, which the Wildensteins sold to the Met in 1967; Pietro Lorenzetti’s The Crucifixion, circa 1340s. The Wildensteins sold it to the Met in 2002; Jean-August-Dominique Ingres’s Comtesse d’Haussonville, 1845, which the Wildensteins sold to the Frick Collection in 1927; Claude Monet’s Jean Monet on His Hobby Horse, 1872. The Wildensteins bought the painting from French-Jewish art dealer Georges Bernheim in 1938, then sold it to a Standard Oil heiress in 1943; Jean-Honoré Fragonard’s The Two Sisters, circa 1769-70, which the Wildensteins sold to the American coal magnate Edward Berwind for $194,000 in 1918; Gustave Caillebotte’s Paris Street; Rainy Day, 1877. The Wildensteins sold it to the Art Institute of Chicago in 1964.

Over recent weeks in hushed New York dining rooms and private Parisian salons, Guy Wildenstein has been a walking object lesson in how billionaire dynasties decline: surrounded by lawyers, pitied, selling off paintings—yet still fabulously rich. This is how it goes when you’re facing a trial in an inheritance-tax case that could cost your clan half a billion dollars. Or at least, what’s left of the clan: His brother, father, and stepmother are dead. It falls to Wildenstein, 70, to ensure the family’s fifth-generation art-dealing fortune makes it to the sixth. Coming up with €448 million ($496 million) in cash—the amount the French government claims his family owes in unpaid taxes and fees—would be enough to bring even the world’s richest to the brink of catastrophe.

Still, life must be lived. Wildenstein parted with $1.2 million worth of old masters at a Christie’s auction in New York earlier this year, and he still has the Manhattan town house he bought for $32.5 million at the end of 2008, though, according to recent press reports, that’s on the block, too. In Paris, where the tax trial will be held, he has the family apartment, though for now it’s been legally seized and the furnishings are under seal. He still goes out in his double-breasted suits to mix with the godfathers of French finance, drawing admiration for keeping up appearances. They know it’s but for the grace of the feared fisc—France’s equivalent of the U.S. Internal Revenue Service—that they themselves aren’t explaining offshore trusts and Picassos in vaults to the taxman. After all, Wildenstein is still one of them: the one who sold his Gulfstream IV to then-Lazard Chairman Michel David-Weill back in 2003; who banks with Rothschild, as his family has for decades; who sustains the Wildenstein Institute, a temple to art history whose catalogues raisonnés for the most important artists of the 19th and 20th centuries are so exhaustive that a work by Monet would be worthless without a so-called Wildenstein index number.

“Nobody’s done as well as the Wildensteins in terms of cash and power and, in a way most important of all, respectability,” says art historian John Richardson. “Nobody.”

(l-r) Daniel, Guy, and Alec, photographed by Helmut Newton in 1999

(l-r) Daniel, Guy, and Alec, photographed by Helmut Newton in 1999“When you were super rich and wanted to show off, you’d go to Wildenstein’s. You could tell everyone back in Chicago, ‘Oh, I was in Wildenstein’s the other day. I’m thinking of buying a Raphael.’”

The family’s business runs on secrets—so fiercely kept that Wildenstein has said he didn’t learn about the family’s financial machinations himself until the death in 2001 of his father, Daniel. When it came time to settle the estate, Guy and his brother, Alec, claimed their father had a net worth of €40.9 million, or about $45 million. To cover the resulting estate tax bill of €17.7 million, they gave the French Republic—Nicolas Sarkozy, then president of France, was a close friend of the family—a set of bas-reliefs by Marie Antoinette’s favorite sculptor. Lovely as the reliefs were, this turned out to be a true let-them-eat-cake moment, tossing crumbs to the French public while, French prosecutors claimed, the Wildensteins were keeping a towering confection of property, art, cash, and investments for themselves. In the month of Daniel’s death alone, the government uncovered a veritable airlift of art, with $188 million worth of paintings moved from the U.S. to Switzerland.

One painting stayed where it was. A Wildenstein-owned Caravaggio hung in a gallery at the Metropolitan Museum of Art in New York. Known as The Lute Player, it was worth tens of millions of dollars, quite possibly more than the entire declared estate. French prosecutors would soon conclude there had to be more like it in the family vaults.

After making an appearance before a judge one morning last January, Wildenstein lurked silently in a corridor outside a criminal courtroom at the Palais de Justice, wrapped in his tan overcoat. He stood behind a lawyer who did all the talking about the unpleasant legal business, which is expected to culminate in a trial later this year.

He had already told his story in the glossy Côte d’Azur beach read Paris Match a few months before. The last time a member of the insular Wildenstein clan made use of the mass media was the first time most Americans heard of the family: In the late 1990s, Guy’s sister-in-law, Jocelyn, courted publicity from New York magazine and Vanity Fair during a divorce from Alec; allegations emerged of Russian models, pet leopards, five-figure laundry and dry-cleaning bills, and Jocelyn’s disfiguring facial surgery, which was, according to Alec, her ongoing attempt to look more like a cat.

“We have always been very discreet people,” Wildenstein told the French magazine. “My father was not worldly, I am not, to the point that almost no one knows what my wife looks like.” (Worldly, of course, is different from global; Wildenstein is a French citizen, born in New York, who educated his children at the Lycée Français on Manhattan’s Upper East Side and Ivy League schools.) He was so down to earth, Wildenstein claimed, that despite being president of the family business, Wildenstein & Co., since 1990, he was in no position to have hidden the family’s fortune from the French government, as he’s charged with doing.

“My brother and I were clueless,” he said. “My father never spoke of his business. He would not come to ask me for advice to manage his fortune or dispose of his property while he was alive. I knew he had the trusts, but he never informed me of detail.” Through a lawyer, Wildenstein declined to comment for this article.

In 1870, Nathan, the founder of the Wildenstein dynasty, left his native Alsace for Paris, where he soon switched professions from hemming pants to hawking paintings and opened his first gallery, on the Rue Laffitte. The art world was in transition: For centuries, the only people who bought and sold oil paintings of any quality were the aristocracy of Europe; there were marriages to arrange, mistresses to flatter, and châteaux and castles to fill with whimsical landscapes and frolicking nymphs. But by the end of the 19th century, that same aristocracy was at the tail end of a 200-year-long decline, ground down by industrial and political revolutions.

The old world’s demise coincided with the rise of the new: Flush with almost unimaginable wealth, American millionaires like the Rockefellers, Fricks, and Guggenheims were eager to buy what the old aristocracy was desperate to sell. Nathan, and then his son, Georges, became the middlemen, arriving cash-in-hand to empty châteaux of masterpieces and then, in turn, sell them. For the best of these works, the next step was inevitably for them to end up in the great museums of the U.S.

Take, for example, Jean-Honoré Fragonard’s The Two Sisters, a lively portrait of two elegantly dressed young women currently on view in Gallery 615 of the Met. First in the possession of the Marquis de Veri, a prolific French art collector, it bounced to another marquis, then to a collection in Sweden, next to the consul general of Russia, and then, in 1916, to the Wildensteins. Their gallery held on to it for two years and then sold it for $194,000 to American coal-mining magnate Edward Berwind, whose family later gave it to the Met. It was just one of many. Berwind, for one, bought another picture, by Marie-Guillemine Benoist, from the Wildensteins that year for $228,000.

In 1903 the Wildensteins opened a satellite gallery in New York; in 1905 they moved their Paris gallery to 57 Rue La Boétie, an ornate mansion designed by Charles de Wailly, who also designed the Paris Odéon. By 1925 there was a Wildenstein gallery in London, and the family was selling artworks for several thousand times the average U.S. annual income. In 1915 they bought the Château de Marienthal, one of the largest private houses in Paris; a few decades later they moved their New York gallery to a five-story mansion on East 64th Street, then bought another mansion a few doors down as the family residence. Daniel, left, and Alec at the New York Gallery in 1965

Daniel, left, and Alec at the New York Gallery in 1965

Daniel, Georges’s son and sole leader of the third generation, was on course to transform the gallery and his family from mere dealers into towering experts in the field. Based for most of his life in Paris (though the private jet, with the family’s insignia of three blue horseshoes on its tail, made continent hopping easy), Daniel fashioned himself as a gentleman-scholar, establishing the Wildenstein Institute in Paris. The institute’s signature was its catalogues raisonnés. Its Monet catalog took 40 years to assemble; its Edouard Vuillard, 60 years. Work of this sort heightened the gallery’s status even further. “I think it was when you were super rich and wanted to show off, you’d go to Wildenstein’s,” says Richardson, who is best known for his multivolume biography of Picasso. “You could tell everyone back in Chicago, ‘Oh, I was in Wildenstein’s the other day. I’m thinking of buying a Raphael.’” Daniel, center, with his second wife Sylvia, and Guy in 1984

Daniel, center, with his second wife Sylvia, and Guy in 1984

In many ways, the Wildensteins’ influence peaked in 1990, the year Guy became president at Wildenstein & Co. and unveiled the Caravaggio that would end up on the Met wall. Long thought to be a copy, the painting was an old master, according to Keith Christiansen, then curator of European paintings at the Met. The news was rolled out with a 50-page catalog and a Met exhibition, A Caravaggio Rediscovered: The Lute Player. A New York Times review called the painting’s authenticity irrefutable and noted that the work had been placed on “long-term loan” at the museum.

Left unsaid was the windfall for the Wildensteins. The Lute Player’s newfound status shifted its estimated value from thousands of dollars to somewhere just shy of priceless. Lists of the most valuable paintings in private hands put its current value at up to $100 million, though the dearth of top-level Caravaggios at auction means assessing its true price is impossible. All of this speculation would be academic—the painting was on loan to a museum, after all—if the Wildensteins hadn’t almost immediately borrowed against the work’s value. While the Caravaggio appreciated in the Met, the family invested the painting’s value as it saw fit.

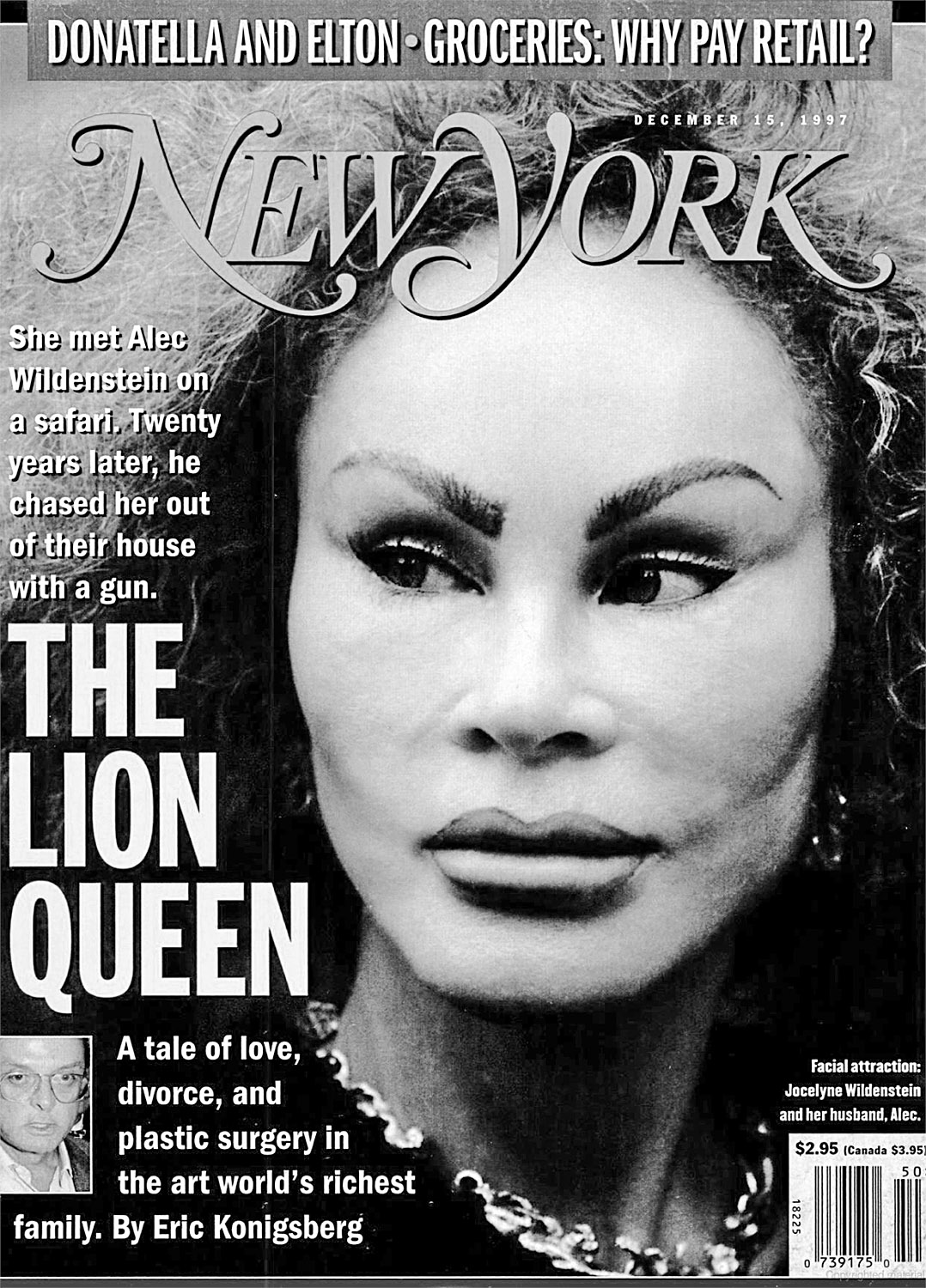

Yet just as Guy, then already 55 years old, was finally easing into the leadership of his father’s business, the business changed. “Now the big money is largely in modernist art,” Richardson says. “And the old master department side of the business, which was their main thing, is not doing at all well.” By the late 1990s the family began to fragment, and its art dealing, at least publicly, began to subside. They were less in the art business than in the being-rich business. And then the Wildenstein women turned the tables. Jocelyn on the cover of New York magazine in 1997

Jocelyn on the cover of New York magazine in 1997

Judging by his reaction, Alec wasn’t expecting his wife to return home on the night of Sept. 3, 1997. Jocelyn had been safely far away at the 75,000-acre Wildenstein ranch in Kenya (the one with the elephants and white rhinos, where Out of Africa was filmed). Arriving at their Manhattan town house, she found 57-year-old Alec with a 19-year-old woman. Alec, furious at the intrusion, brandished a semiautomatic pistol while holding a towel around his waist. Jocelyn called the police, and Alec spent the night in jail. The ensuing divorce, played out in the New York tabloids, was just a preview of how the family’s finances would be exposed following the patriarch’s death four years later.

In October 2001, Daniel, who had battled cancer, fell into a coma. His second wife, Sylvia, sat vigil by his hospital bed until his death on Oct. 23. Two weeks later, she signed away her rights to her late husband’s estate. According to Sylvia, her stepsons—Guy and Alec—had told her the taxes would bankrupt her if she didn’t. It wasn’t until two years later that she hired a lawyer. She eventually filed a lawsuit against Guy and Alec claiming, among other things, that she was bilked out of her inheritance and that the family was sitting on trusts and real estate worth not millions of dollars, but several billion.

The French tax authorities took notice and began looking more closely at Daniel’s estate—and came to believe that they, too, got lowballed.

As French prosecutors would later learn, simultaneous to the Wildensteins’ claim in court that Daniel’s estate was worth no more than $45 million, the family’s representatives were negotiating to borrow $100 million using $250 million worth of art as collateral, according to correspondence on the deal from a Cayman Islands unit of Coutts & Co., known as the Queen’s bank because Elizabeth II is a client. The proposal called for the Wildensteins’ Delta Trust to pledge a mix of pieces by artists from diverse periods. (The works in the trust included, in addition to paintings from Pierre Bonnard and Fragonard, a Picasso sketch of Guy and Alec’s grandmother, Madame Georges Wildenstein, from 1918.) In exchange, Coutts would supply the cash and invest it on behalf of the Delta Trust. The deal wasn’t completed, according to a person familiar with the negotiations.

In 2005 the Paris appeals court voided the inheritance agreement Sylvia had signed and ordered a full inventory of the family’s properties, ranging from homes in New York and France to the Kenyan ranch, trusts, racehorses, and art. Amid the upheaval, Alec died in 2008. Sylvia died next, in 2010. That left Guy, known as the more diligent brother—he dutifully showed up to work at the New York gallery every day and, perhaps just as important, never made headlines for marital infidelities—to bear the full brunt of the French government’s investigation.

The French fiscal authorities notified the remaining Wildenstein heirs in 2011 that their audit had found taxable assets totaling €615.7 million—more than 10 times what the family originally declared. That tally included 19 Bonnard paintings valued at €64.9 million that had been stored at the Geneva Free Ports & Warehouses (held in a trust named after Sylvia) and €281.3 million of paintings held by the Delta Trust. Yet even this figure is modest compared with what the tax authorities would ultimately produce. The Delta Trust alone, they now say, has a value of $1.1 billion.

This time around, the tax bill won’t be covered by the donation of bas-reliefs. The French government issued a proposition de rectification that demanded an additional levy of €469.4 million, including interest and penalties. Later the figure was lowered to about €448 million.

On April 9, 2015, investigative judges in Paris indicted Guy and other defendants, including Alec’s widow (he had remarried) and son and several advisers to the family, on charges related to the handling of Daniel’s estate. Along with the $188 million art airlift, investigators claimed a further $850 million worth of paintings inside the trust were dispersed around the world, with most in Switzerland and bits scattered in Paris, London, Buenos Aires, Tokyo, and other cities, the indictment says.

The Wildensteins, who maintain the validity of their original tax claim, asserted in court that the assets held in trusts weren’t legally Daniel’s to take at will. Instead, they belonged to the trusts and therefore shouldn’t count for estate taxes. Prosecutors countered that the trusts aren’t truly independent, pointing to evidence that the Delta Trust became a source of bounty for Guy and Alec, to whom dozens of artworks totaling tens of millions in value were distributed from 2001 through 2004. It’s preposterous, prosecutors asserted, to claim that no one actually owned paintings worth hundreds of millions of dollars.

Dozens of major assets still have escaped full scrutiny, and they will at least until the French authorities—who can levy estate taxes on assets held anywhere—have fully worked out who owns what. New York properties, including the Wildenstein & Co. headquarters, for instance, which the family came close to selling to the Qatari government for $90 million in 2014 (Qatar pulled out), private jets, and even the Caravaggio, don’t factor into France’s tax claims. There’s also no mention of stocks, bonds, or cash. The full extent of the Wildensteins’ wealth is unknown. But there is a very public record of the transactions behind the family’s fortune—and its reputation. You just need to look on the walls of the world’s greatest museums.

Millions of visitors to the Art Institute of Chicago have admired Gustave Caillebotte’s Paris Street; Rainy Day, from 1877, one of the most famous paintings of the 19th century. The Wildensteins sold it to the Art Institute in 1964.

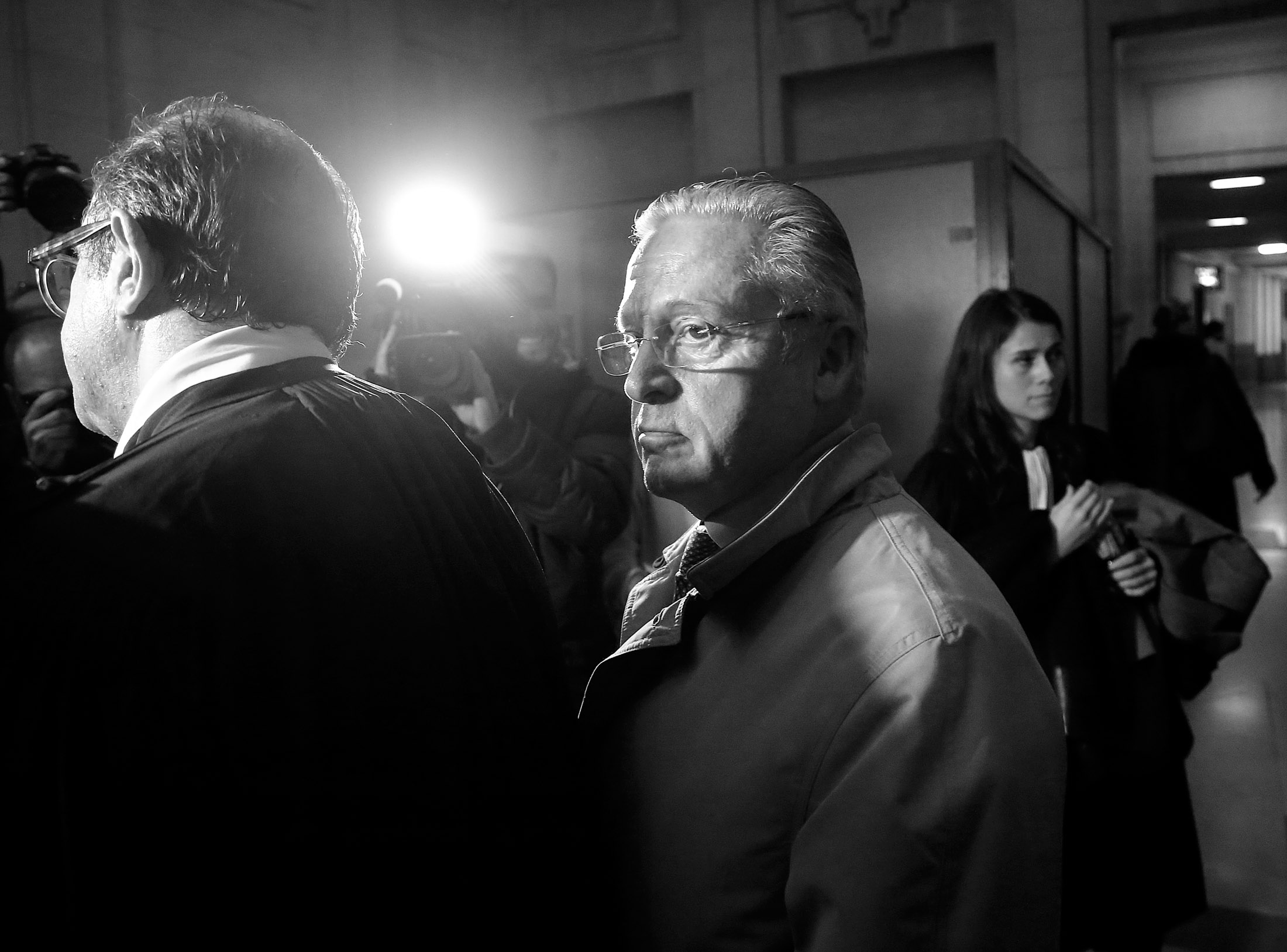

The Met has its own list of masterpieces connected to the family. Walk up the grand main staircase, and you’ll come to the entrance of the immense European Paintings galleries, a labyrinth of rooms with dark oil paintings in heavy gilded frames. Close to half of the section’s 44 galleries have at least one painting with Wildenstein provenance; Gallery 615 alone has seven that were once owned by the family. Guy with his lawyer in January 2016

Guy with his lawyer in January 2016

Wildenstein art at the Met isn’t just old masters. When Walter Annenberg, the publishing billionaire, donated 50 impressionist paintings to the museum in 1991, the New York Times estimated their total value to be “roughly $1 billion.” Twenty-seven of the 50 were purchased from the Wildensteins or passed through their hands, including a stunning green-and-white still life, Roses, by Vincent van Gogh.

All told, at least 360 objects in the Met have a Wildenstein provenance. They include oil paintings, drawings, watercolors, sculptures, tapestries, and even gilded mirrors. Taken alone, they would constitute a world-class museum.

One work, however, would be missing from this hypothetical mini-Metropolitan: In 2013 the Wildensteins quietly removed The Lute Player from the Met’s walls. The long-term loan had been terminated. Outsiders speculated that with Daniel and Alec dead, the heirs besieged by lawsuits, and the art-dealing business a shadow of its former self, the prestige of having a $100 million painting hanging in a museum had ceased to outweigh the security of having a $100 million painting in the family vault. Where that vault might be, exactly, is a matter of speculation.

—With Gaspard Sebag